The economy needs innovation to thrive. But innovation is risky and does not always bring immediate benefits. The economy therefore needs banks to finance innovation projects, but these are apparently not the most profitable in the short term for banks. So how can we ensure that banks finance innovation projects? The law must intervene. But in what way?

The subject may seem abstract to you, but it is very policy-oriented. What type of financial reforms do we need to stimulate innovation output? This is the research objective of our study published in the Journal of International Money and Finance.

As a first step, let’s simplify our research question. The economy needs innovation to thrive. But innovation is risky, not always beneficial and takes time. Despite innovation not being the most profitable investment choice in the short term, the economy needs banks to finance innovation ideas. We illustrate this with a simple example, imagine that you want to invest 10 euros and you have to consider two options. The first option is to invest 10 euros in a project that yields 100 euros immediately without any risk. The second option yields possible earnings of 1000 euros in a month’s time but without a guarantee. For a policy maker, the potential outcome of the second investment choice remains significant as it is associated with substantial gains for the economy’s prosperity. Therefore, the key question posed to policymakers is what sort of policy reforms we should propose to banks to ensure that banks will lend these 10 euros to entrepreneurs that invest in innovation projects. In other words, we need policy initiatives that encourage banks to finance innovation. What do these initiatives look like? This is exactly the question we address in this research.

Two types of reform

We have studied the effect of financial reforms implemented in 21 OECD countries from 1981-2005. Specifically, we explore the relationship between two types of reforms (Abiad et al 2010) and patents (innovation output). For understanding this relationship, we first consider the channel through which firms receive funds from banks. The work scheme is very simple firms borrow from banks to invest in R&D (innovation input), which is converted into patents (innovation output). Therefore, we explore the kind of reforms that ensure the most cost-effective borrowing terms for firms.

Read also: The rise of international mergers and acquisitions in football

The first type of reform, the one we call micro reform, includes policies that promote competition between a large number of banks in the market. Essentially, this means that Governments implement reforms to remove banking barriers. To achieve this, the pathways are to ease restrictions for foreign banks to enter the domestic market, allow banks to develop a broader scope of financing activities, remove restrictions within geographical areas, and simplify licensing and bureaucratic requirements. Once more banks exist in the market, competition increases. To survive competition, banks should attract customers by offering low-interest rates.

The second type of reform, the one we call macro reform, includes policies that remove credit controls by allowing banks to hold lower reserve requirements. Banks are usually asked to keep reserves that can be lent towards specific sectors, to hold liquid reserves that can be used to buy government bonds and to keep a certain amount of their deposits within the Treasury of the Central bank. All these requirements restrict banks’ options to finance alternative investment projects that generate economic growth.

The “reserve paradox”

In principle, both micro and macro reforms are designed to support the real economy. Nonetheless, the macro reform of lower reserve requirements induces a paradox. As banks hold lower reserves, this increases the probability of bank default because some investors will be unable to repay their loans. This can cause financial instability. Recent experience has shown that increased liquidity has been the main source of all financial crises including the most severe financial crisis of 2008 in the US. We know that credit oversupply can be hazardous and distortive to the financial system.

Banks encounter default risk from excess liquidity by insuring their deposits. This prudential act ensures that there will not be any bank runs, depositors going to banks to withdraw all their money. Despite deposit insurance offering security to the financial system, it increases the cost of borrowing as part of the insurance premium passes through to the lending interest rate. Therefore, firms can afford to borrow less to invest in innovation. This is exactly what we refer to as the “reserve paradox”, which highlights the adverse effect of liquidity on innovation. Our theoretical model proposes two propositions concerning the relationship between financial reforms and innovation activity:

(a) Policies that remove barriers to entry in the banking sector are more effective at promoting competition among banking rivals, which decreases the cost of lending for R&D investment.

(b) Policies that lower reserve requirements increase the cost of borrowing as banks are covered for the higher default rate through higher insurance premiums.

The effect of micro reform

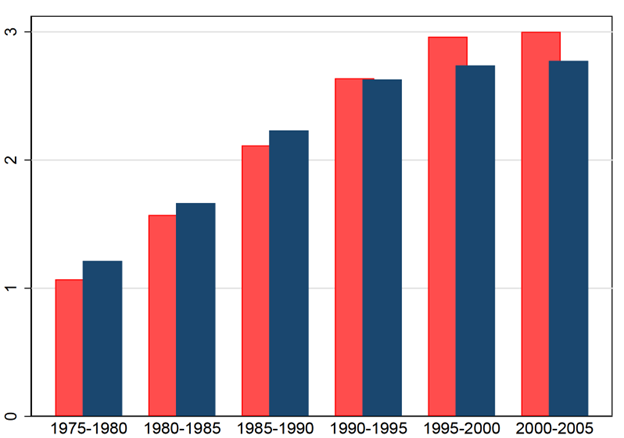

These two propositions are elaborated within an endogenous growth model that shows how policy changes in the financial sector impact the R&D sector (the innovation sector). During the period we studied, OECD countries implemented financial reforms towards a progressively more liberalized system, fewer barriers to entry in the banking sector, and fewer reserve requirements. In the early 1980s, both entry and credit requirements in the banking sector showed a partially repressed environment, which was essentially fully liberalized in the first half of the 2000s. There are no major policy reversals suggesting that all developed countries by the mid-2000s operate in a fully liberalized financial system.

The empirical analysis of the study reveals that macro reform as defined by lower reserve requirements in the banking sector dampens R&D activity and patent growth across countries in the long run. The size of this effect is one per cent annually indicating that R&D capital decreases on average by 1.273 USD million every year because of lower credit controls. The effect of micro reform as defined by increased competition in the banking sector supports R&D and patenting activity across time and countries.

Read also: Are secondary markets the missing link in equity crowdfunding for startups?

Interpreting our findings, the main policy lessons can be summarized as follows: First, we should not take for granted that all types of financial reforms are effective in enhancing the performance of sectors crucial to technological progress, such as innovation. Easy access to credit at a competitive rate is critical for firms that invest in R&D, but it can be more easily achieved by fostering competition in the banking sector rather than necessarily deregulating credit control or providing higher degrees of liquidity. Reforms that favour liquidity induce risks, which make banks less willing to finance R&D projects or if they do they increase the cost of lending. Policymakers and central bankers should maintain their skepticism about whether credit ceiling removal can work well for sectors with high risks.

For macro reforms to serve the needs of the real economy a strong monitoring mechanism should also be in place to ensure that funds from increased liquidity are allocated optimally. Higher liquidity alone does not entail a higher supply of funds and a lower lending rate for R&D firms. Research on the topic does not stop here. Future attention should be focused on alternative aspects of financial policy instruments and how these can promote innovation and R&D activity including interest rate controls, international capital flows and state-owned banks. There is ample scope for future research in the field to help us understand what sort of financial policy can more effectively promote innovation and growth.