You should not see sustainability reporting as a burden. Our research, based on a study of 74 European banks, shows that the banks with the highest ESG scores are also the least risky. Sustainability is the future of banking.

You might have heard about the “ESG reporting burden” aiming at financial and later on non-financial firms reporting about their eligibility & alignment on all environmental objectives?

You might know as well that it is more and more difficult for financial institutions to ensure their long-term viability, measured among other KPIs by their Risk and Performance Ratios.

If this is the case, then you could be interested in the results of our research, evidencing a positive impact of Sustainability on the banks’ reliability.

Instead of the additional costly constraint it could represent, adopting an ESG compliant strategy and sticking to it is proving viable in the long run by strengthening the whole financial system.

Profitability is not enough

Although most examinations focus on the impact of ESG on profitability, the impact on financial stability cannot be underconsidered. That is why, in our study, we focused on the positive impact of the ESG score rather on the banks’ soundness than on their profitability.

We have found that the higher the ESG score of the European Financial Institutions, the better their risk profile, measured through the Non-Performing Loans (NPL) Ratio, representing the proportion of the total of loans that are in default or close to default, itself being closely monitored by the Competent Authorities. Our hypothesis was based on the assumption that the Financial Institutions’ ESG scoring is improving their capacity to attract good payers and/or better assesses the borrowers’ capacity to pay their dues. Indeed, a sustainable bank focused on eco-friendly and ethical lending practices may have lower exposure to industries with high environmental risk, attract more stable customers, and have a robust and transparent management, which leads to informed decisions and better assessment of loan risks.

The higher the ESG score…

In result of our research, we found that the European Banks, faced with so many challenges, of both regulatory and market nature, were able to be less risky lenders if they had a better governance integrity score, better human resources management, and were environmentally responsible.

Based on the analysis of 74 European banks, for which ESG score and NPL Ratio data were available on the Refinitiv database, we have proven that the most engaged in sustainability European banks are granted a better risk profile. A negative regression coefficient (of -0.04) for the ESG score to the NPL ratio relationship has been evidenced.

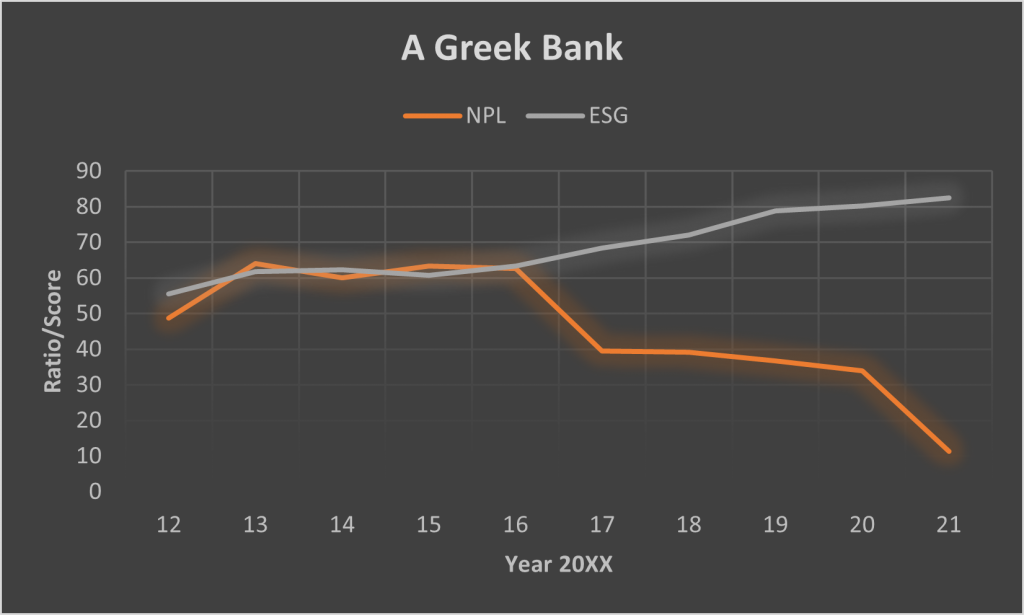

The following example of a Greek Bank, is well illustrating this negative relationship, with its ESG score increasing while the NPL Ratio decreasing and vice versa:

The responsible behavior of banks is effectively positively related to their ability to apply the needed risk management policies to avoid lending to risky, potentially defaulting counterparties. Three models have been applied to measure the importance of this relationship: the General Linear Model, the Linear Mixed Model, and the General Regression Model. We also used a set of control variables. We found that the higher the ESG score, the lower banks’ Non-Performing Loans (NPL) Ratio.

Our findings are comforting other researchers’ ones, for example “the Contribution of ESG information to the financial stability of European Banks” evidenced by Toth et al. (2021) or the ESG scores improving the US Banks’ market value found by Ersoy et al. (2022).

“Only 22.2% of all firms reported their total greenhouse gas emissions”

As a result of the study, our main recommendation is to catch the opportunity to engage the earliest possible in the path towards sustainable development in the long run, which would allow us to achieve a sound business management process. As suggested by the LSEG’s Trading and Banking Summit’s exchange about the decarbonisation journey, since we will be faced with the regulatory constraints, better would be to act proactively rather than “suffer” a posteriori from their enforcement.

KPMG says that to comply with the Sustainable Finance Disclosure Regulation (SFDR), for example, “firms have spent three years entirely overhauling their investment processes, product strategies and reporting operating models”. And despite that effort, according to gfmreview, today, “the majority of companies do not make any disclosures against 12 of the 17 mandatory indicators” and “only 22.2% of all firms reported their total greenhouse gas emissions, 14% in the US and just 3% in China.”

To remediate this situation, the compliant European Fund and Asset Management Association recommends aligning investee companies’ reporting of ESG data with fund managers’ ESG disclosure requirements. Indeed, the current review of the SFDR is ensuring that “the European Sustainability Reporting Standards (ESRS) cover the information which financial market participants need to be able to disclose principal adverse impact (PAI) indicators regarding investments in investee companies under the delegated act of the SFDR”.

Long term is back

So you could see the ESRS and equivalents as an open door towards better organization of our society that, despite the cost of restructuring and reorganization it would imply, would globally help improve the long term viability of the business activities and reduce the risk of their financing.

That would also improve the level of mutual reliance between banks and their customers, as well as their reputation and brilliance reach out through the disclosures to domestic and international stakeholders and authorities worldwide. Indeed, Sustainability theory points out that disclosing ESG-related information leads to company social recognition. A huge volume of academic literature deals with the positive impact of ESG performance on firm value.

The WEF Davos 2023 stated, “From an investment perspective, incorporating ESG analysis alongside traditional financial factors adds to our holistic understanding of risk and opportunities and long-term value outcomes.”

That is normally what, in fine, every economic agent is searching for, and that is why the ESRS and equivalents should be seen as an opportunity to revive and strengthen the economy rather than as a burden.

This article was inspired by Korteza Delacroix’s capstone, which you can read below.