The justification for socially responsible investing (SRI) is primarily ethical. Taking into account certain variables of corporate social responsibility (CSR) can also be a source of financial outperformance. In this respect, the promotion of workplace gender equality is an aspect of CSR that can contribute to company performance. We demonstrate that a stock portfolio composed of CAC 40 companies that have achieved near gender parity not only outperformed the French stock market index, but also reduced risk by lessening the effects of the downward corrections of the financial markets during the COVID-19 crisis.

Why this study?

Socially responsible investing (SRI) is currently popular with investors and has resulted in a rapid increase in assets under management by financial institutions. This investment category offers investors the possibility of investing their savings in something meaningful and of having an impact on society while supporting companies that behave ethically and virtuously. However, stock performance remains a concern for investors.

In this period marked by a major financial crisis due to the COVID-19 pandemic, we analyse how making a socially responsible investment based on gender diversity within a company can contribute to the stock market performance of said investment. SRI is also a source of performance, because it enables investors to take into account non-financial information ─ such as gender equality ─ that is pertinent in terms of its impact on society but seldom used in investment strategies. The justification for SRI is then no longer purely ethical, since SRI also becomes a source of additional information enabling investors to make better decisions about their financial investments.

Workplace gender equality is a major societal issue that some socially-responsible investors wish to promote. The ethical justification is evident: ensuring equal opportunity for all. Several scientific studies support the hypothesis that companies with a more diversified workforce also perform better. Having a diversity of profiles improves decision-making processes and the ability to assess risks. A diverse workforce implies that the company is open to all talent sources available on the job market and equal opportunity is a source of motivation for all. Diversity brings with it a broader range of knowledge and improves consumer understanding while fostering creativity and innovation.

Consequently, diversity resulting from the promotion of gender equality constitutes a SRI or “non-financial” variable that can contribute to a company’s financial results and, ultimately, influence its stock market performance.

Diversity within the board of directors is often used to measure diversity within companies. However, the presence of female board members is more a matter of complying with legislation (quota of 40% imposed in France by the Cope-Zimmermann law) or is even sometimes a form of social window-dressing to satisfy the stakeholders in the company rather than the reflection of a true desire to promote workplace gender equality. Moreover, the presence of a greater number of women on corporate boards does not necessarily result in greater gender balance within the company itself, whether on the executive committee, in middle management, or among other staff. Finally, in terms of financial performance, academic research is particularly circumspect about the link between diversity on boards of directors and the stock market performance of companies.

For these reasons, we examine the impact that diversity in middle management has on company performance. Middle management is essential to the proper functioning of companies and therefore to their performance. This stratum is especially important because it translates the company’s strategy into concrete action and is the intermediary between senior executives and the rest of the employees. Moreover, the feminisation of middle management concerns a very large section of a company’s workforce and thus, unlike boards of directors or executive committees, cannot be easily manipulated by the recruitment of a few women, and the sustainability of its diversity can have a lasting impact on the company’s performance.

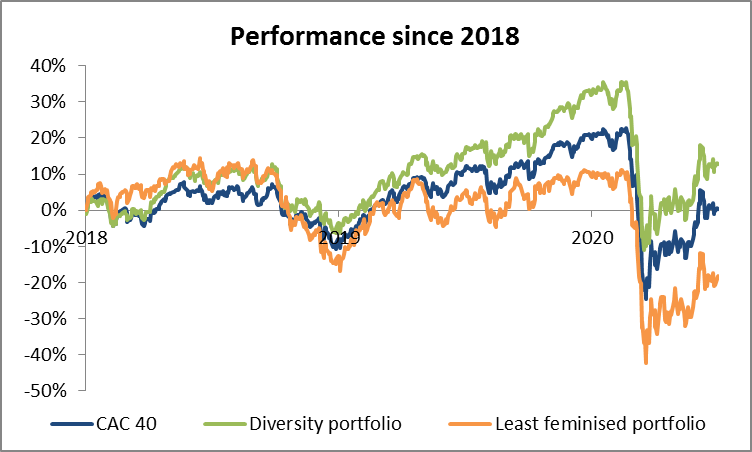

Drawing from an original database containing the 40 companies making up the French CAC 40 index, we put together a “Diversity” portfolio comprising the companies that are the closest to achieving parity in their management, as well as a “Least feminised” portfolio composed of the companies that have the least women in management. In an earlier article, we had used a similar approach to show that a portfolio put together on the basis of this method had outperformed the CAC 40 over the 2008-2018 period. We replicated the study by comparing these two portfolios to the CAC 40 between 1 January and 30 June 2020 and during the financial crisis period triggered by the COVID-19 pandemic between 19 February and 18 March 2020.

The “Diversity” portfolio outperforms the CAC 40 from 1 January 2020

The “Diversity” portfolio is made up of the ten companies with the most feminised management. Within these companies, the percentage of women in management varies from 46% to 65% (average of 54.26%), i.e. a level very close to parity. These companies are BNP Paribas, Danone, EssilorLuxottica, Hermès International, Kering, LVMH, L’Oréal, Société Générale, Téléperformance and Vivendi.

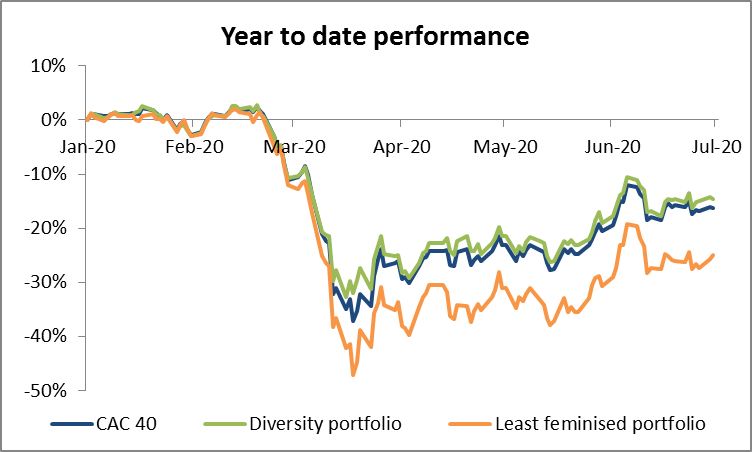

Between 1 January and 30 June 2020, our “Diversity” portfolio outperformed the CAC 40 by 1.5% (CAC40: -16.2% and “Diversity” portfolio: -14.7%)[1].

This performance is not due to short-term effects or simply to chance, because this portfolio also outperformed the CAC 40 by 4.6% in 2018 (CAC 40: -8.1% and “Diversity” portfolio: -3.6%) and by 6.5% in 2019 (CAC40: +30.5% and “Diversity” portfolio: +36.9%). There is therefore a persistence of relative performance that has lasted three years so far.

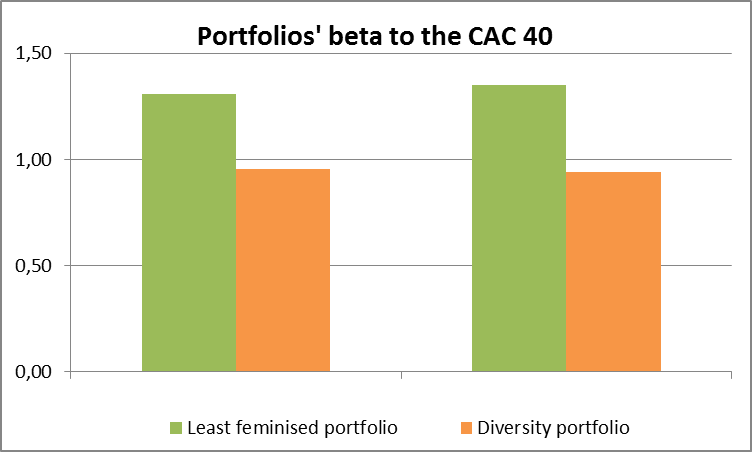

Moreover, for an investor, the “Diversity” portfolio is a stock market investment with a lower level of risk compared to that of its reference index. It has a beta in relation to the CAC 40 of 0.94 since the beginning of 2020 and 0.96 since the start of 2018. In other words, the outperformance observed is not linked to exposure to a risk greater than that represented by an investment in the CAC 40. The increased performance therefore carries no additional risk for the investor. To put it another way, the performance gain is entirely reflected in the risk/return combination.

The “Diversity” portfolio shows a resistance to the COVID-19 stock market crash

The majority of the outperformance of our “Diversity” portfolio was achieved this year between 19 February, the CAC 40 high point, and 18 March, the CAC 40 low point, i.e. during the stock market crash caused by the COVID-19 pandemic. During that period of significant market correction around the world, the “Diversity” portfolio did fall, but by 4.9% less than the French stock market index (CAC 40: -38.6% and “Diversity” portfolio: -33.7%). This result is also consistent with what we had found for the 2008-2018 period. A “Diversity” portfolio tends to protect investors during periods of market downturn.

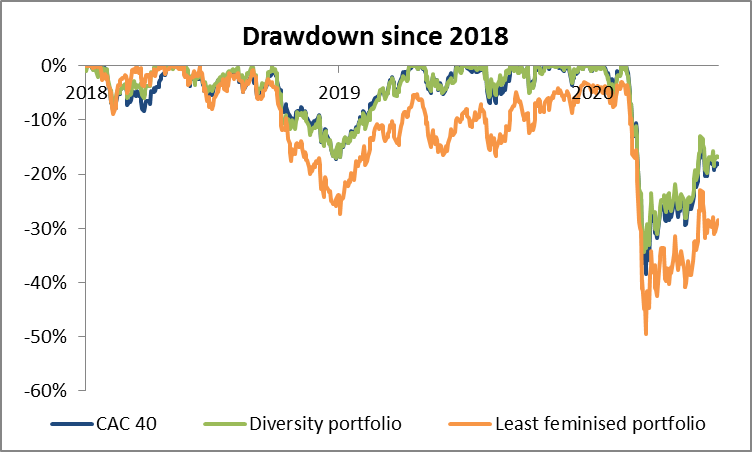

The historical drawdown is the maximum loss suffered by an investor who took a position at the peak of the market, and it is a measure of the risk taken by an investor. This risk measure shows that our “Diversity” portfolio has less exposure to market risk because its drawdown is 4.9% lower than that of the CAC 40 during the crisis period. As was the case for the 2008 stock market correction, it would seem that having quasi-gender parity in middle management is a protection against financial crises.

“Least feminised” portfolio: weaker performance for a riskier portfolio

We simulated a symmetric portfolio made up of the ten least feminised companies in the CAC 40. In these companies, the percentage of women in management varies from 12.6% to 19.9% (average of 16.79%). The “Least feminised” portfolio includes Airbus, Arcelor, Bouygues, Dassault Systèmes, Legrand, Peugeot-Citröen, Renault, STMicroelectronic, Thales and Vinci.

The portfolio underperformed the CAC 40 by -8.8% from the beginning of 2020 (CAC 40: -16.2% and “Least feminised” portfolio: -25%). We also noted an underperformance of -4.6% in 2018 (CAC 40: -8.1% and “Least feminised” portfolio: -12.7%) and of 5.5% in 2019 (CAC 40: 30.5% and “Least feminised” portfolio: 25%).

During the financial crisis brought on by COVID-19, this portfolio was also more heavily penalised than the CAC 40 when the financial markets crashed between 19 February and 18 March 2020 (CAC40: -38.6% and “Least feminised” portfolio: -47.6%, i.e. an underperformance of -9%). The drawdown of the “Least feminised” portfolio, or in other words its maximum loss during the stock market crash in February-March 2020, is much higher (-47.6%) than that of the CAC 40 (-38.6%) and that of the “Diversity” portfolio (-33.7%). This higher drawdown means that this portfolio carries a higher maximum loss risk for investors. Moreover, this portfolio is characterised by a much higher level of risk than the CAC 40, because its beta stands at 1.35 since the beginning of 2020 and 1.31 since 2018.

The performance of a “Least feminised” portfolio is a near-perfect mirror image of our “Diversity” portfolio. It is characterised by an underperformance against the CAC 40 and by greater risk for investors.

Given the limited size of the portfolios, the results obtained could be due to one or two of the securities having a strong upward or downward performance. In this case, the results would not be linked to the “diversity” aspect, but rather to the chance of having chosen a few values with a strong performance in one direction or the other. A detailed analysis of the portfolios shows that this is not the case, since eight of the securities in the “Diversity” portfolio outperform the CAC 40, while seven securities in the “Least feminised” portfolio underperform the French reference index. Granted, the luxury exposure of the “Diversity” portfolio has largely contributed to its performance since the beginning of the year, but the two banks in the portfolio penalised it greatly ─ without them the portfolio results would have been much more spectacular!

Conclusion: diversity, an SRI criterion that protects against COVID-19

Our previous studies highlighted the link between the performance of companies and the gender diversity in their middle management. During the financial markets crisis caused by the COVID-19 pandemic, a stock portfolio composed of the companies closest to achieving gender parity proved more resistant to the stock-market crash, yielded better returns in the medium term and was less risky. Conversely, a portfolio composed of the least feminised companies suffered a greater drop during the stock market crash, yielded lower returns in the medium term and represents a more significant risk for investors.

Investing in companies that encourage the feminisation of their management teams to promote workplace gender equality proves to be a sound investment strategy for an SRI fund. Employee diversity constitutes a sustainable competitive advantage that is reflected in the company’s financial and stock market performance. This advantage is sustained through the current crisis.

This conclusion may be highlighted by SRI activist funds looking to incite companies to increase diversity in both their management and in the corporate governance body that remains the least feminised, namely the boards of directors (only 17.49% of the board seats of the sixty companies making up the CAC 40+20 are held by women[2]).

Finally, contrary to certain composite CSR ratings whose criteria and weightings can sometimes seem obscure, the percentage of women at the different levels of a company constitutes a simple indicator of corporate social responsibility that can easily be verified by investors wishing to have an impact on society.

[1] The performance of the shares was calculated by including dividend payments

[2] SKEMA Observatory on the Feminisation of Companies