The 2020 Nobel prize for Economics was awarded to Paul Milgrom and Robert Wilson for their contributions to auction research. My colleague Bernard Sinclair-Desgagné wrote an article on his advisor Paul Milgrom.

Auctions are commonly used in many different situations (e.g., art, fish, flowers, online advertising, public procurement, and online auctions). But at the same time, many products are sold through posted prices or negotiations, not auctions. In the joint article with Dan Bernhardt and Tingjun Liu, published in Journal of Economic Theory, we identified the “value discovery” as the merit and the “participation cost” as the demerit of auctions in order to study the most profitable way to sell. We find that the relative size of participation cost over the benefit of value discovery determines not only when to sell by auctions instead of selling by negotiations or posted prices, but also whom to favor and the extent of such favoritism.

Value discovery: the merit of auctions

To understand the benefits of the “value discovery,” let us first consider a case of price negotiation. Suppose that I am the only buyer of your car that you want to get rid of and I am willing to pay up to €10,000 for your car. Then, I will pretend that I am not that interested in your car when bargaining over the price. You may not be completely fooled, but you may agree to sell your car at a lower price, say €6,000.

However, if you sell your car by auctions, it is a different story. I would like to keep the price as low as possible, but I can’t pretend that I’m not that interested and bid really low, because I fear being outbid by another buyer. Thus, I bid higher. As I expect fiercer competition with other buyers, I raise my bid even more, approaching my true valuation €10,000.

In other words, through competition in the auction, the bidding price will rise close to the true valuation. This means that the winning bid approaches the valuation of the person who values your car the most. I call this the value discovery through auctions, because you as a seller cannot know the valuation of the person who values your car the most, but auctions effectively (almost) discover that value.

Participation cost: the demerit of auctions

However, the downside of auctions is the “participation cost.” There is non-monetary cost of waiting for the auction to take place and waiting for the other participants to finish bidding. In addition, large-scale auctions such as license auctions and corporate takeover bids require due diligence in preparation for the bidding process, which is very costly. For all but the winning bidder, these participation costs are non-recoverable and thus wasted.

You may think that the participation costs are incurred by the buyers, and thus not relevant to the seller. However, that is not the case. For example, let’s say Company SK is not interested in participating in the auction because it does not expect to win the auction at a sufficiently low price to recover its participation cost. In order to encourage Company SK to participate, the seller needs to give some “carrot” to Company SK, for example, by making the shipping cost free, or lowering the handling fee or the minimum bid price. Of course, the seller must pay the cost of these carrots. The higher the cost of participation, the more money is needed for the carrots, so sellers want to be selective in attracting auction participants.

How to Sell?

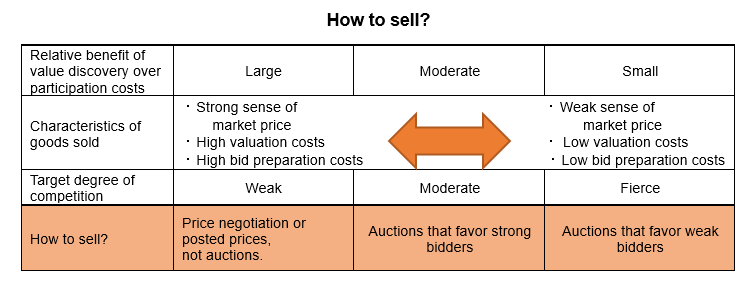

So what is the most profitable way to sell? The answer depends on the relative benefit of value discovery over participation costs. In what follows, I consider three cases, where the participation cost is (1) high, (2) low, or (3) moderate relative to the size of value discovery. We find that, the higher the participation cost, the greater the need to save money on the carrots to encourage participation, so it is desirable to sell through posted prices or negotiations in case (1), and it is desirable to sell through auctions in cases (2) and (3), where the participation cost is relatively low. However, the best way to run the auction is different.

- Case (1) when the participation cost is high relative to the size of value discovery:When the participation cost is too large relative to the benefit of the value discovery, e.g., when there is a strong sense of market price, auctions are not suitable. You should not auction off a bottle of shampoo that is known to be sold at €10 elsewhere. An auction is time-consuming and tedious, so buyers will participate only if they expect that the winning bid is less than €10. But, do you want to sell it through an auction to the buyers who expect to pay less than €10? Of course not. you should post the market price of €10 and sell it.

- Case (2) when the participation cost is low relative to the size of value discovery:When the cost of participation is small relative to the benefit of value discovery, selling by auctions is a great way to sell because this is when you do not know the valuations by potential buyers. When you do not know how much you should charge, holding an auction is an effective way to discover the proper value through competition.Furthermore, when the cost of participation is relatively small, auctions that favor weak bidders (who probably bid a lower amount) are known to be good at raising bids in expectation. To see the logic, let’s consider an example of a large business and a new small business competing for the exclusive right to sell a certain product. If they compete on a level playing field, the former will probably win. This is because a large business with existing sales channels and excellent human resources can expect higher profits from the same exclusive sales right, and also because it has the financial strength to pay a higher bid. If the large business thinks that it can surely win, it will lower its bid. Therefore, in this case, if the small business is given a moderate amount of preferential treatment, the effect of competition can be reinforced and the winning bid amount can be raised.In fact, the U.S. government provides subsidies to a few percent of the winning bids of domestic businesses and small businesses when conducting auctions, and offers preferential borrowing rates to prevent foreign capital and large businesses with financial power from monopolizing the market.

- Case (3) when the participation cost is moderate relative to the size of value discovery:However, according to the authors’ research, when the participation cost is moderate in relation to the benefit of the value discovery, the expected winning bid will be higher in an auction that favors strong bidders who are likely to bid high and win.In this situation, the value discovery effect is sufficiently large that the seller should not completely eliminate competition. On the other hand, as mentioned earlier, the seller needs to pay for the carrots to buyers to encourage their participation, so it is necessary to be selective in attracting bidders to save the cost of carrots. In this situation, the value discovery effect is sufficiently large that the seller should not completely eliminate competition. On the other hand, as mentioned earlier, the seller needs to pay for the carrots to buyers to encourage their participation, so it is necessary to be selective in attracting bidders to save the cost of carrots. The selling method that saves on the cost of carrots while maintaining competition is the preferential treatment of strong bidders who are likely to bid high and win.

In addition, we analyzed a situation where the goods have asset characteristics (e.g., the exclusive sales right to sell products) and a royalty of a percentage of the income from the auctioned asset (e.g., sales revenues from the exclusive sales right) is paid in addition to the winning bid price. For example, the winner of a U.S. oil field concession auction pays the government about 16% of the revenue from the extracted oil in addition to the winning bid.

Our analysis showed that when royalties are paid in addition, there is an additional benefit of favoring strong bidders who are likely to bid high and win. This is because the royalty income reduces the benefit of discovering a buyer’s valuation.

How to sell? If the goal is to increase expected sales, the target degree of competition is determined by the relative benefit of the value discovery relative to the participation cost (See the table). Depending on the target degree of competition, we can decide not only whether to auction, negotiate prices, or sell by posting prices, but also whom to favor and to what extent.

This article is translated and modified from my article published on March 6, 2021 in the WEEKLY TOYO KEIZAI (in Japanese): https://premium.toyokeizai.net/articles/-/26314.