Kraft Heinz: Breakup with benefits?

Love stories can sometimes end badly… After 10 years together, Kraft and Heinz have just announced their split. A blessing in disguise? Or perhaps an opportunity to analyze the strategic consequences of such a breakup.

When Kraft Heinz announced in September 2025 that it would split into two independent companies, the move marked the unwinding of one of the most high-profile mergers in the food industry. A decade after Kraft and Heinz joined forces under the sponsorship of Warren Buffett and 3G Capital, the company has decided that separation, not integration, offers the best path forward.

From a strategic perspective, the Heinz case offers an excellent opportunity to analyze the benefits and costs of demergers, and to reflect on why these corporate moves so often produce one clear “winner” and one struggling “laggard.”

A familiar Story

History provides many parallels. Hewlett-Packard’s decision in 2015 to divide into HP Inc., focusing on PCs and printers, and Hewlett Packard Enterprise, focusing on infrastructure and services, reflected the need for different strategies and capital priorities. In 2000, Andersen Consulting broke away from Arthur Andersen, later rebranding as Accenture. That split not only resolved internal tensions between auditing and consulting but also proved decisive for survival, since Accenture thrived while Arthur Andersen collapsed after the Enron scandal. In the food industry itself, Kraft Foods divided in 2012, creating Mondelez International for its snacks and confectionery portfolio, and Kraft Foods Group for its North American grocery lines. Mondelez became the growth engine, while Kraft was later absorbed into Heinz. More recently, giants such as Kellogg, Johnson & Johnson, and GE have all embraced breakups as a way to sharpen strategic focus.

Why Companies Choose to Demerge

The rationale is consistent across these cases. Different businesses often require different strategies, cultures, and capital allocation models. When they are kept together, they generate internal compromises, distract management, and obscure the value of each unit in the eyes of investors. Demergers promise to resolve these tensions by giving each new company the freedom to pursue its destiny.

The Strategic Benefits of Breaking Up

The advantages of separation are evident in the Heinz case. It allows each entity to focus on its own priorities without the compromises that come from living under the same roof. Global Taste Elevation, which includes Heinz ketchup, Philadelphia cream cheese, and Kraft Mac & Cheese, can concentrate on international growth, premium positioning, and brand-driven innovation. North American Grocery, built around Oscar Mayer, Kraft Singles, and Lunchables, can dedicate itself to operational excellence and cost leadership in a mature domestic market.

Clarity also improves in the eyes of investors. Markets tend to value “pure play” businesses more transparently, rewarding growth businesses with higher multiples and treating mature, cash-generating units as reliable income stocks. Hidden value is often unlocked in the process. Moreover, separation allows management teams to adopt distinct cultures: entrepreneurial and fast-moving in one unit, efficiency-obsessed and risk-averse in the other. Perhaps most importantly, management attention becomes more focused. Leaders are no longer stretched between businesses with fundamentally different dynamics, and each team can devote itself fully to its core challenges.

The Strategic Costs and Risks

Yet demergers are never without costs. They inevitably sacrifice some of the synergies that justified earlier mergers, such as shared procurement, combined distribution networks, and cross-brand marketing. When Kraft and Heinz merged, analysts estimated they realized between $1.5 and $2 billion in annual synergies. A share of these savings will now be lost.

Demergers also come with heavy disentanglement costs, from reconfiguring IT systems to duplicating HR, legal, and finance functions. Kraft Heinz itself estimates spending up to $300 million on the split, with the risk of further “stranded costs” if duplicated headquarters and overheads are not removed quickly. Beyond the numbers, demergers reduce scale and bargaining power, particularly in negotiations with powerful retailers such as Walmart. They also make each entity more vulnerable to the cycles of its specific industry: Global Taste Elevation will depend heavily on continued appetite for international brands, while North American Grocery will be tethered to the slow-growth U.S. staples market. Finally, the act of demerging itself demands immense managerial energy, creates uncertainty among employees, and risks diverting focus from the marketplace.

A Quantitative Lens

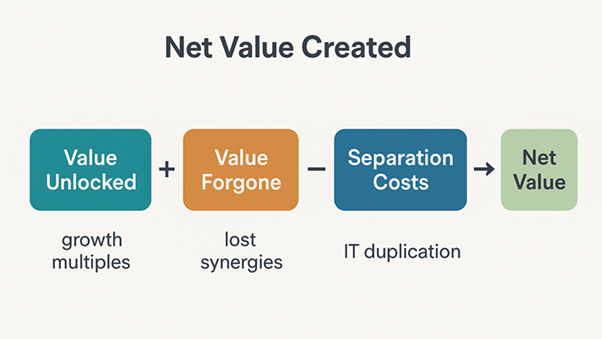

A recent McKinsey analysis, aptly titled The cost of (un)doing business, offers a useful equation for assessing these trade-offs. The net value of a divestiture or demerger equals the value unlocked, minus the forgone value, minus the costs of separation.

Applied to Heinz, the equation suggests both opportunity and risk. By removing the conglomerate discount from its current market capitalization of around $45 billion, Heinz could unlock four to five billion dollars in value. If markets award higher valuation multiples to Global Taste Elevation, the upside could stretch to as much as ten billion. On the other hand, losing a portion of merger synergies might erase three to six billion in value, while separation costs and stranded overhead could absorb a further one to two billion. The optimistic scenario suggests seven to twelve billion in value creation. The base case suggests only modest gains of up to five billion. In the pessimistic scenario, Heinz could actually destroy up to four billion in value.

Winners and Laggards

What emerges is the familiar “winner–loser” dynamic. In most demergers, one entity becomes the growth engine, attracting investor enthusiasm, top talent, and capital. The other becomes the laggard, weighed down by slower growth, stranded costs, and structural headwinds. For Heinz, the likely winner is Global Taste Elevation, with its international brands, innovation potential, and higher valuation multiples. The likely laggard is North American Grocery, tied to mature categories and exposed to retailer pressure, unless it can reinvent itself.

Lessons from the Heinz Breakup

The Heinz breakup illustrates a broader paradox in corporate strategy. What once seemed like a bold combination designed to extract synergies can later be unwound to unlock agility and focus. Whether in merging or demerging, the ultimate question is always the same: are the resulting businesses better owners of their assets than they were before?

Read also: Can corporate fraud be a winning strategy?