What if you bought a piece of “All I Want for Christmas Is You”?

You might soon enjoy listening to All I Want for Christmas Is You even more. Like many other songs, Mariah Carey’s hit could soon end up on a music marketplace and become yours to own, in part. Music is becoming…

Torn in the USA: Hello Protectionism, Goodbye Free Trade

Recent U.S. customs policies have marked a paradigm shift. Washington is now openly embracing protectionism, with a focus on reshoring production and promoting the ‘Made in America’ movement. This new direction is redefining the rules of the global economy and…

Private Equity: Can we Trust Evergreen Funds?

Private equity for everyone—that’s the promise. Evergreen funds are booming, making private equity more accessible than ever. But this new investment vehicle is reshaping the very structure of corporate financing. How can we strike the right balance between risks and…

Les plus lus

Is Warren Buffett the exception that proves the rule?

INTERVIEW OF RICHARD DAVIES, AUTHOR OF ‘EXTREME ECONOMIES’

The unexpected relationship between religion and economic development

Why do ex-French Sub-Saharan colonies fare better economically than ex-British ones?

Finance: where are the Women?

What is factoring?

Medias

All articles

How to design efficient defined contribution pension systems?

Defined contribution pension systems offer solutions to the problem of an ageing population, but they also present many challenges. The oldest of these, in Chile, is a relevant example. Few subjects touch upon everyone’s lives and generate so much controversy…

Will neobanks replace traditional banks?

“I’m my own banker.” This slogan for a French neobank sums up the concept quite well. Will the all-digital services offered by neobanks replace or complement those offered by traditional banks? Their recent rise raises questions about the future of…

Why do ex-French Sub-Saharan colonies fare better economically than ex-British ones?

Does the colonial history of sub-Saharan African countries still play a role in their economic performance? Ioannis Bournakis (SKEMA Business School), Marian Rizov and Dimitris Christopoulos compared the performance of 35 of these countries over more than 40 years: those…

Innovation needs financial competition, not deregulation

The economy needs innovation to thrive. But innovation is risky and does not always bring immediate benefits. The economy therefore needs banks to finance innovation projects, but these are apparently not the most profitable in the short term for banks.…

Are secondary markets the missing link in equity crowdfunding for startups?

While the prevalence of equity crowdfunding has increased, investors have had very few opportunities to exit such investments. Thus, several equity crowdfunding platforms have started considering the development of secondary markets for buying and selling shares. Using detailed data from…

The rise of international mergers and acquisitions in football

Football has entered a new era. Mergers and acquisitions’ one. It offers new opportunities for big clubs and smaller ones, but this represents a new challenge for the sport: what about equity in a business world? The examples of Strasbourg…

An excess profits tax may compensate the Covid crisis losers

The Covid-19 crisis and its aftermath have allowed companies to make excess profits. Our study shows that a tax on these excess profits could compensate those who have suffered most from the crisis. Recent geopolitical events have demonstrated that a…

Forecasting the present: The role of Google data in assessing real-time economic conditions

What if we could forecast the present? If you are not an economist, this question may seem silly. For example, if you want to know the weather today, all you have to do is to open the window and to…

The American prison system or the business of incarceration

The United States has the highest prison population rate in the world with 655 prisoners per 100,000 inhabitants – nearly six times more than China – and is home to a quarter of the world’s convicts. Might the land of the free also be the land of freedom deprivation? Undoubtedly, but it is also the land of business opportunity, where half of inmates work in prison, sometimes for the private sector. A business that generates several billion dollars in profit each year…

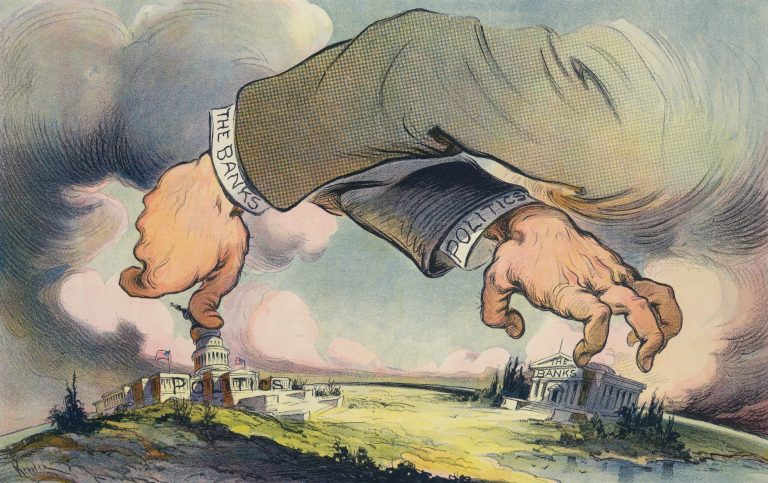

Corporate political connections: how do they affect corporate transparency?

Government interacts with private businesses in a number of ways: it regulates them, it taxes them but it also purchases goods and services from them and it provides financial help to them – which in particular in times of pandemic can be substantial. There is hence clearly an incentive for firms to establish close connections to politicians. What are the economic effects of such connections? And how do they affect corporate transparency?

Digital money, private and public: is this the face of the future?

The simultaneous and in some cases competing development of new payment methods, the rise of cryptoassets and the emergence of private and/or central bank digital money. These new solutions pose numerous questions and will have fundamental macroeconomic, political and ecological impacts...

Is Facebook’s Diem the future of cryptocurrency or a financial pipe dream?

Facebook founder Mark Zuckerberg took everyone by surprise on 29 October last year when he announced not only the parent company’s change of name to “Meta”, but also the imminent creation of a virtual world, the “Metaverse”, to exist beyond…

Is Warren Buffett the exception that proves the rule?

Warren Buffett is generally considered to be one of the world’s most talented investors. His recurrent impressive performances over a forty-year period have made him a legend, contradicting the efficient market hypothesis.

Does his performance demonstrate a special talent, or is it all down to luck?

MARKET EFFICIENCY: LET’S SET THE RECORD STRAIGHT!

In the book "Fault Lines: How Hidden Fractures Still Threaten the World Economy" Raghuram Rajan asks why, during the 2006 crisis, the banks whose share prices had risen the furthest were in fact the worst performers. Given that all public information is reflected into the stock prices, shouldn’t they reflect the quality of the balance sheet and the potential for profit? Is this proof of market inefficiency?

INNOVATION IN THE PHARMACEUTICAL INDUSTRY: THE PRIVATE SECTOR IS OUT OF THE DRIVING SEAT

The pharmaceutical industry, faces a paradox: the Covid-19 vaccine was created in just one year, compared to the usual ten years, even though the financialisation of the pharmaceutical industry has caused R&D spend as a proportion of turnover to dip in many countries....

Instability, a challenge for economic theory and policy

Faced with the conjunction of the financial, health and ecological crises, economic thought is in disarray. A deep-rooted idea remains that these crises are mere digressions, from which we should be able to return at the previous state. However, there are grounds for believing the hypothesis that our economic model is undergoing a profound transformation....